The Fed Cuts and Projects More Easing to Come

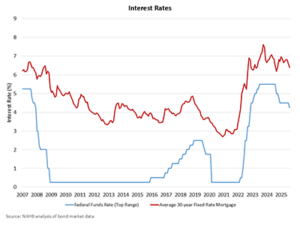

After a monetary policy pause that began at the start of 2025, the Federal Reserve’s monetary policy committee (FOMC) voted to reduce the short-term federal funds rate by 25 basis points at the conclusion of its September meeting. This move decreased the target federal funds rate to an upper rate of 4.25%.

After a monetary policy pause that began at the start of 2025, the Federal Reserve’s monetary policy committee (FOMC) voted to reduce the short-term federal funds rate by 25 basis points at the conclusion of its September meeting. This move decreased the target federal funds rate to an upper rate of 4.25%.

Economically, the cut is justified given signs of a softening labor market and moderate inflation readings. However, Chair Powell characterized today’s easing as a “risk management cut,” rather than one driven by fundamental changes in the economic outlook. NAHB is forecasting another 75 basis points of easing in the coming quarters, with 25 of that total coming before the end of the calendar year.

The Fed announced no changes to its ongoing balance sheet reduction policy. While the Fed is easing on the short-end of the yield curve, the ongoing quantitative tightening (QT) program is still exerting upward pressure on mortgage interest rates and is partially responsible for the elevated spread of mortgage rates over the 10-year Treasury rate. The Fed’s balance sheet has contracted from almost $9 trillion in May 2022 to $6.6 trillion in September. A hypothetical slowing of QT for mortgage-backed securities would reduce mortgage interest rates, perhaps by 25 basis points.

The Fed summarized current economic conditions as follows: ...read more